All Categories

Featured

Table of Contents

- – Five-Star Accredited Investor Investment Funds

- – Groundbreaking Accredited Investor Real Estate...

- – Top Accredited Investor Investment Funds

- – High-Growth Accredited Investor Opportunities...

- – Turnkey High Yield Investment Opportunities ...

- – Turnkey Private Equity For Accredited Investors

- – Unmatched Private Placements For Accredited ...

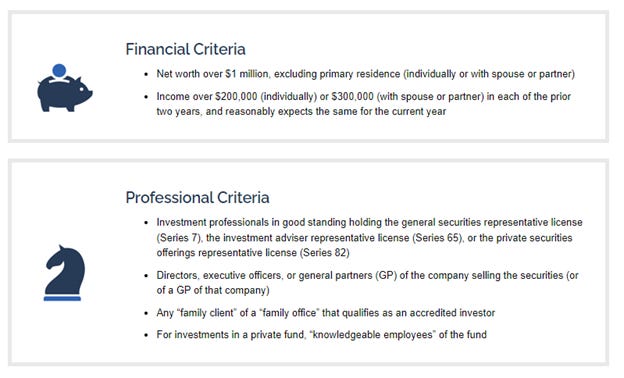

The laws for certified capitalists vary among territories. In the U.S, the interpretation of an approved capitalist is presented by the SEC in Policy 501 of Regulation D. To be a certified capitalist, an individual has to have an annual revenue surpassing $200,000 ($300,000 for joint income) for the last 2 years with the expectation of earning the same or a higher income in the present year.

This amount can not consist of a key house., executive policemans, or directors of a company that is releasing unregistered protections.

Five-Star Accredited Investor Investment Funds

If an entity consists of equity owners who are approved investors, the entity itself is an accredited capitalist. However, a company can not be created with the sole objective of purchasing specific protections - accredited investor real estate investment networks. A person can certify as an approved investor by demonstrating enough education or job experience in the financial sector

Individuals who want to be accredited investors do not relate to the SEC for the designation. Rather, it is the duty of the company offering a personal placement to make certain that every one of those come close to are approved capitalists. Individuals or celebrations who wish to be recognized financiers can come close to the company of the unregistered safety and securities.

Suppose there is an individual whose income was $150,000 for the last three years. They reported a main home worth of $1 million (with a mortgage of $200,000), an auto worth $100,000 (with a superior car loan of $50,000), a 401(k) account with $500,000, and a financial savings account with $450,000.

Net well worth is calculated as possessions minus obligations. He or she's total assets is specifically $1 million. This includes an estimation of their properties (aside from their main home) of $1,050,000 ($100,000 + $500,000 + $450,000) less a cars and truck finance equating to $50,000. Considering that they meet the net worth demand, they certify to be a recognized financier.

Groundbreaking Accredited Investor Real Estate Deals

There are a few less typical credentials, such as managing a trust with greater than $5 million in possessions. Under federal safety and securities legislations, just those that are accredited investors might take part in certain safety and securities offerings. These may include shares in personal positionings, structured items, and private equity or hedge funds, to name a few.

The regulators intend to be certain that participants in these highly risky and complicated investments can take care of themselves and judge the threats in the lack of federal government security. The recognized investor regulations are created to protect potential financiers with limited monetary knowledge from adventures and losses they might be ill equipped to hold up against.

Accredited investors meet qualifications and professional criteria to gain access to unique investment possibilities. Accredited investors need to satisfy income and internet well worth demands, unlike non-accredited individuals, and can spend without constraints.

Top Accredited Investor Investment Funds

Some crucial changes made in 2020 by the SEC consist of:. Including the Series 7 Collection 65, and Collection 82 licenses or various other credentials that show financial expertise. This change recognizes that these entity kinds are often made use of for making investments. This modification recognizes the competence that these workers create.

This modification accounts for the effects of rising cost of living in time. These changes broaden the certified investor pool by around 64 million Americans. This wider accessibility supplies much more chances for financiers, yet likewise increases potential threats as less financially innovative, investors can participate. Services utilizing private offerings might profit from a larger swimming pool of prospective investors.

These investment options are special to recognized capitalists and institutions that certify as a recognized, per SEC regulations. This offers recognized financiers the possibility to spend in emerging firms at a stage before they take into consideration going public.

High-Growth Accredited Investor Opportunities for Expanding Investment Opportunities

They are seen as financial investments and come just, to qualified customers. Along with recognized business, certified investors can choose to spend in start-ups and promising endeavors. This uses them tax returns and the opportunity to get in at an earlier phase and potentially enjoy rewards if the business succeeds.

For financiers open to the dangers included, backing start-ups can lead to gains (Accredited Investor Opportunities). Numerous of today's tech firms such as Facebook, Uber and Airbnb originated as early-stage startups sustained by approved angel financiers. Advanced capitalists have the chance to discover investment options that might generate extra earnings than what public markets use

Turnkey High Yield Investment Opportunities For Accredited Investors for Accredited Investor Deals

Returns are not guaranteed, diversification and portfolio enhancement alternatives are increased for investors. By diversifying their portfolios via these increased investment opportunities approved capitalists can boost their strategies and possibly achieve superior long-lasting returns with appropriate threat monitoring. Skilled financiers usually come across investment alternatives that may not be easily offered to the general financier.

Financial investment alternatives and protections supplied to accredited financiers typically entail higher threats. Private equity, endeavor capital and bush funds usually concentrate on spending in assets that carry risk yet can be liquidated quickly for the possibility of higher returns on those risky investments. Looking into before investing is essential these in scenarios.

Lock up durations avoid capitalists from taking out funds for more months and years on end. Investors might struggle to accurately value private possessions.

Turnkey Private Equity For Accredited Investors

This change may extend certified capitalist status to an array of individuals. Allowing companions in dedicated relationships to combine their sources for shared qualification as recognized capitalists.

Enabling individuals with certain expert accreditations, such as Collection 7 or CFA, to certify as recognized capitalists. This would certainly acknowledge economic sophistication. Developing additional needs such as proof of economic proficiency or efficiently completing an accredited financier exam. This could ensure capitalists understand the threats. Limiting or getting rid of the key residence from the internet well worth calculation to lower possibly filled with air evaluations of riches.

On the various other hand, it might also result in knowledgeable investors assuming too much dangers that may not appropriate for them. Safeguards might be required. Existing recognized investors might face boosted competition for the very best investment chances if the pool expands. Firms increasing funds may benefit from an increased certified capitalist base to draw from.

Unmatched Private Placements For Accredited Investors

Those that are currently taken into consideration accredited investors have to remain updated on any kind of modifications to the criteria and guidelines. Their eligibility could be subject to modifications in the future. To keep their condition as certified financiers under a revised definition changes might be needed in wealth monitoring strategies. Organizations looking for recognized investors should stay cautious about these updates to ensure they are bring in the right target market of financiers.

Table of Contents

- – Five-Star Accredited Investor Investment Funds

- – Groundbreaking Accredited Investor Real Estate...

- – Top Accredited Investor Investment Funds

- – High-Growth Accredited Investor Opportunities...

- – Turnkey High Yield Investment Opportunities ...

- – Turnkey Private Equity For Accredited Investors

- – Unmatched Private Placements For Accredited ...

Latest Posts

Investing Tax Lien

Investing Tax Lien

Unpaid Tax Land For Sale

More

Latest Posts

Investing Tax Lien

Investing Tax Lien

Unpaid Tax Land For Sale